does colorado have a solar tax credit

How does a solar panel business make money. So the only tax credit you can claim is the ITC that the federal government offers.

Is Solar Worth It In Colorado Colorado Solar Panels 2021 Solar Website

The ITC is a federal program that allows anyone paying federal income tax to reduce their income tax liability by 26 percent of the cost of their solar system including contractor and installation costs wiring inverters racking and.

. Chief among these is the solar investment tax credit ITC. But no need to be gluma 30 cut in your expense is a pretty big deal. Thats not so surprisingWe dont actually have state income tax after all.

Tennessee doesnt currently have a tax credit for homeowners switching to solar. There are also financial incentives available at the federal level. Federal Solar Tax Credit.

However the residential federal solar tax credit cannot be claimed when you put a solar PV system on a rental unit you own though it may be eligible for the business ITC under IRC Section 48. Whether you work with a franchise or wholesaler your installation business makes money through the successful installation of solar units. Some leasing programs generate regular income by charging their customers a monthly bill which includes the cost of the panel installation and any extra power the.

Solar PV systems do not necessarily have to be installed on your primary residence for you to claim the tax credit.

How Much Do Solar Panels Cost In Colorado Reenergizeco

Federal Solar Tax Credit 2022 How Does It Work Sunpro Solar

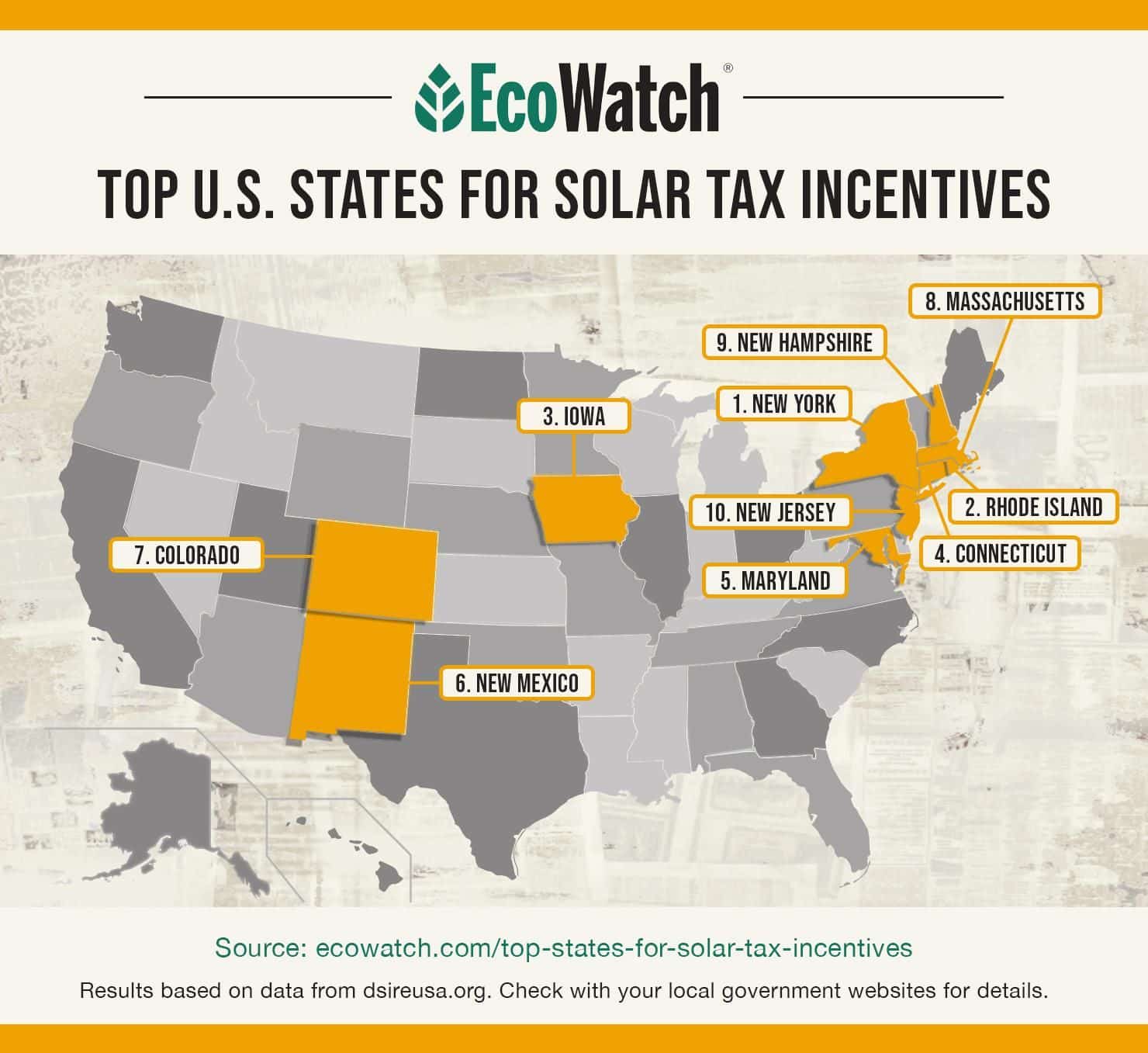

10 States With The Best Tax Incentives For Solar Energy Ecowatch

Colorado Solar Incentives Colorado Solar Rebates Tax Credits

Is Solar Worth It In Colorado Colorado Solar Panels 2021 Solar Website

Is Solar Worth It In Colorado Colorado Solar Panels 2021 Solar Website

How Much Do Solar Panels Cost In Colorado Reenergizeco

Colorado Solar Incentives Five Things Residents Need To Know Ion Solar